Tax Planning for Growing Businesses

Tax Planning for Growing Businesses Tax planning is an essential component for growing businesses, as it allows you to optimize the tax burden and ensure

Protect your wealth and optimize your tax obligations with specialized legal support.

We provide comprehensive legal solutions in tax and accounting law, aimed at regulatory compliance, efficient tax planning and defense before the Internal Revenue Service (SRI).

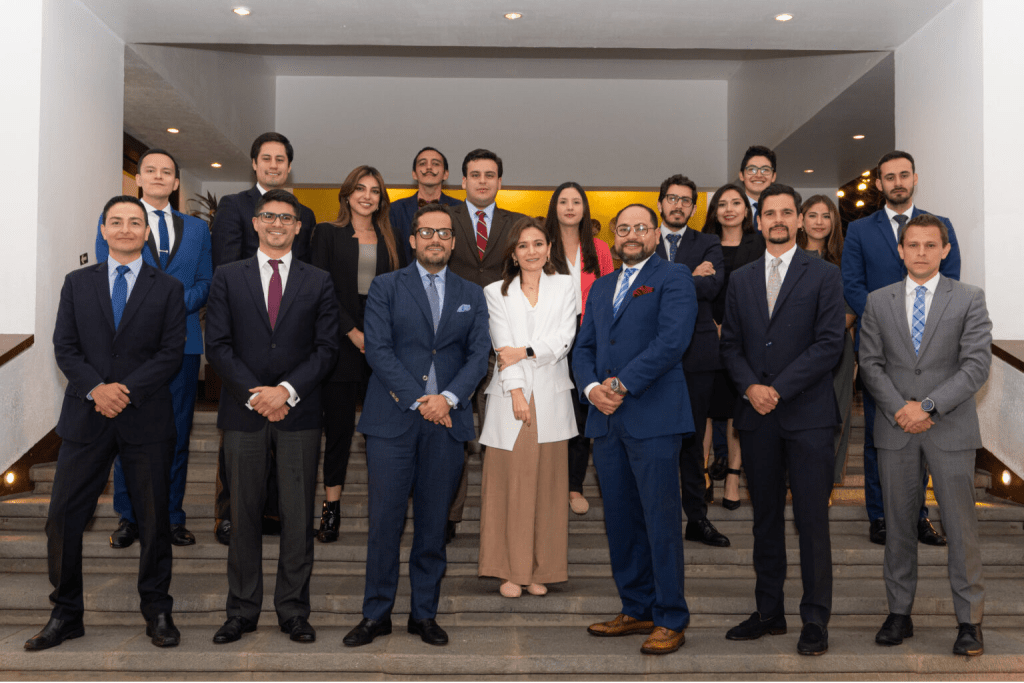

We have a multidisciplinary team of specialized lawyers and accountants who will accompany you at every stage of the tax process, from tax filing to representation in tax litigation.

We design legal strategies to optimize your tax burden, aligned with your business or wealth reality.

Advice on the preparation and filing of returns with the SRI, including VAT, RENTA, ICE and RIMPE.

Detailed analysis of your tax situation, identification of errors, risks and opportunities for improvement.

Legal defense before the SRI, including appeals for review, administrative claims and contentious-tax trials.

Consulting on transfer pricing, double taxation avoidance agreements and structuring of global operations.

Legal representation in cases of alleged tax fraud, shell companies or double accounting.

Tax planning for inheritances, legacies, donations and asset protection in accordance with the law.

Our experience allows us to anticipate possible tax contingencies, reduce the tax burden in a legal way and provide peace of mind in the face of any inspection or procedure.

We identify tax risks and design tax strategies within the current legal framework.

We approach each case with tailor-made solutions, integrating accounting, financial and legal.

We accompany you in administrative processes, audits, tax and criminal litigation, protecting your interests.

With more than 17 years of experience, we leads a team with a proven track record in tax advice, providing strategic solutions to companies, entrepreneurs and individuals.

We have successfully advised processes such as:

Our experience allows us to anticipate possible tax contingencies, reduce the tax burden in a legal way

Analysis, practical guides and legal guidance on the issues that most concern our clients.

Tax Planning for Growing Businesses Tax planning is an essential component for growing businesses, as it allows you to optimize the tax burden and ensure

Double taxation: how to benefit from international treaties Double taxation occurs when the same income or profit is taxed in two or more countries, which

Tax Fines in Ecuador: Common Causes and How to Avoid Them Compliance with tax obligations is essential for businesses and taxpayers in Ecuador. However, it

"We received a notification from the SRI for alleged inconsistencies in our statements. We were very worried. Expert Attorneys analyzed everything thoroughly, presented our defenses, and helped us avoid an unfair penalty. His technical handling was impeccable."

"We are a growing SME and we were not clear about how to structure our tax burden. The team of Expert Lawyers advised us to optimize our accounting processes, avoid errors and comply without risks. We feel much calmer and focused on the business."

"We engage their services for a full tax review before an external audit. They helped us correct omissions, prepare key documentation, and align our reports. It was a totally wise investment. We avoid fines and gain financial order."

To start our collaboration, the first step is to fill out our short online contact form. This allows us to understand your preliminary needs and schedule an initial call or Strategic Consultation, usually within 24 business hours. In this first interaction, we will delve into your case, resolve key concerns, and, if applicable, define together the most effective legal roadmap for you

We offer an initial Strategic Consultation designed to provide you with tangible value from our first meeting. This session, lasting 60 to 90 minutes and can be held in our offices or by videoconference, has an investment of $100 USD (+VAT).

It is not a simple introductory talk. Includes:

This value is creditable to the fees if you decide to hire our services for the execution of the defined strategy. We seek to establish a relationship of trust based on transparency and the value delivered from the beginning.

Our decisive advantage lies in a unique combination of expertise that you will hardly find in any other firm in Ecuador: the sophistication of the high business strategy, forged in top-tier firms, and the practical and deep mastery of the Ecuadorian state system, acquired from within. This translates into solutions that go further: not only do we protect your interests with the utmost legal rigour, but we also anticipate regulatory risks, optimise public-private management and accelerate your results in a more effective and efficient way. We are the strategic partner that dominates both sides of the game to ensure your success.

Avoid penalties, optimize your finances, and comply with the law. Request your consultation with our tax lawyers.

Lexintel Law Firm | All right reserved | Privacy Policy